Mergers and acquisitions are commonly used with corporate, business and international strategies. It should be used to increase firm value and lead to strategic competitiveness and above average returns. In the decade of 1980, management scholars and intellectuals were focused on Mergers and Acquisitions as these business activity was most widespread. In the decade of1990’s, the approach of many businesses in considering Mergers and Acquisitions will be a more strategic and coherent procedure with special respect of the ethical consequences on the many parties affected.

Merger

Merger is explained in management studies as two firms agree to assimilate their operations on a relatively co-equal basis. Basically, a merger is unification of two or more firms into one entity, with the purpose of increasing profit and high value to the stakeholders. It can be stated that merger usually occurs within companies who have similar business, with an objective to scale-up the operations. Acquisition normally indicates acquiring/buying of a smaller company by huge company in the similar line of business. Acquisition can be either normal (by consent) or forced (by acquiring large amount of shares in a company). For Example, United Breweries acquired Shaw Wallace’s liquor business.

There are many types of business combinations known as mergers: Conglomerate merger, horizontal merger, market extension merger, vertical merger, Concentric Mergers and product extension merger (Dash, 2010).

Conglomerate Mergers: A conglomerate merger involves the procurement of a dissimilar business. The acquired firm is usually one of many under the corporate umbrella of the acquiring firm and is perceived as providing profitable diversification. Since the two firms are unrelated in product or service, internal changes to the acquired firm, which will remain relatively autonomous, are likely to be minimal, and there will be few cultural consequences. Occasionally the acquiring firm will send a new team from headquarters to manage the unit (Nahavandi and Malekzadeh 1993), which will cause conflict among the senior executives of the acquired firm and may result in a higher quit rate among its employees and feelings of insecurity and instability. Despite these problems, ‘conglomerate takeovers tend to be the most benign of all the sources of cultural change’ (Walter 1985).

Vertical Mergers: In this category of merger, a firm purchases one of its suppliers or merges with one of its customers. Because an acquired firm generally falls under the acquiring firm’s corporate umbrella, most of the interaction between the two firms is at the corporate level. The level of complexity at the corporate level increases, as do the rules governing the acquired corporation, which faces a reduction in self-determination. This leads to the demotion of subsidiary executives to middle management (Walter, 1985), which often leads, in turn, to a higher level of executive turnover, particularly if ‘the executives of the acquired firm are treated as if they have been conquered, causing them to feel inferior and experience a loss of social standing’ (Nord 1994).

Horizontal Mergers: In horizontal mergers, one firm acquires another company whose product or service is closely related or of the same type (Nahavandi and Malekzadeh 1993). An example of a horizontal merger is that of two soft drink companies. The firms are competitors producing similar products. The main aim of a horizontal merger is to increase revenue by offering an additional range of products to existing customers.

Market Extension Merger: A market extension merger specifies a merger of two firms that manufacture the same or identical products but they sell it in completely different markets. For example, a local or domestic software developing company is taken over by a multinational software developing company. Product-Extension Merger: A product-extension merger designates a merger of firms that do not manufacture the same goods but they manufacture goods that fall in the same category. For example, if a company manufacturing laptops overtakes a company that manufactures ‘portable hard disks’ or ‘flash drives’, then this would be termed as a product-extension merger. Here the laptop and the portable hard disk are two different products but they both come under the category of computers. Concentric Mergers: Concentric mergers take place between two firms with highly similar production or distributional technologies (Walter 1985). In this type of merger, mergers occurs between firms that serve the same customers in a particular industry, but they do not offer the same products and services. Their products may be complements, product which go together, but technically not the same products.

There are numerous reasons for corporations to participate in mergers and acquisitions. The most widespread in recent years being growth through external instead of internal means. Such growth may benefit the acquirer by increasing capability for product diversification, expansion of existing product lines and increasing market share. Other assessable reasons for entering into mergers include achieving economies of scale for operations and obtaining tax advantages (Larsen, 1991). An important feature of merger and acquisition strategy focuses on strengths and goals before taking actions. Managers and management accountants, as partners in the strategic planning process, must take a thoughtful view of potential activity, to observe a basic compatibility between the two companies, to determine whether the product mix makes sense, and to decide if the companies’ core beliefs are the same (Pouvot, 1991).

Mergers and acquisitions strategies:

Acquisition: Acquisition is explained by scholars as one firm buys a controlling, 100 percent interest in another firm with the intent of making the acquired firm a subsidiary business within its portfolio. The acquisition process is a five stage procedure.

- Goal (and Stategy) Definition

- Selection and Review of Targets

- Forecast Evaluation

- Analysis

- Management Review and Decision

- Negotiation and acquisition (Allison, 1984).

Stage One: Goal (and Strategy): In the first stage, the acquiring company must set forth its goals, objectives and strategic plan which should include alternatives to the proposed acquisition. This is performed during the strategic planning process when the firm attempts to match its organization with the varying environment. As the business environment changes, the organization is exposed to numerous threats to its economic stability and opportunities to expand its markets. Some organizations adjust to their varying environment by implementing variations in their structure. These changes may influence the firm’s association to its environment and have an impact on the firm’s efficacy, or, the changes might instead relate to the external operations of the firm and effect its efficiency (Armitage, 1990). Management accountants serve as major professionals on the management decision making team and their expertise enables the growth and implementation of a firm’s strategy.

Stage Two: Selection and Review of Potential Targets: The second stage of the process of acquisition involves screening of target companies. The management accountant can support in targeting potential merger or takeover candidates by identifying firms with underestimated assets resulting from conservative accounting policies. Furthermore, the management accountant may select to employ available multivariate models based on a series of accounting ratios in a firm’s efforts to recognise the best acquisition aspirants. Computer models, using data from annual reports, SEC filings could then be used to create a set of financial projections based upon different assumptions made about such factors as the hurdle rate, capital investment level and success of the applicant. The candidate’s expected performance would be revealed in terms of cash flow and standard financial statements. This data could be used in another model to scrutinise the implications of alternative financing strategies. Lastly, yet another model could be used to generate projected combined data reports at the corporate level.

It has been observed that sometimes the acquirer’s first impressions of the company and its management team can affect its interpretation of the target’s value (Richards, 1986). Therefore, the target company is assessed in terms of its growth potential, market share of the products it makes, technology and potential synergies (Allison, 1984). Growth potential and market share of its products are obvious criteria to consider when a company is a takeover aspirant. The marketing department of the acquiring company evaluates the relative market share of the target’s products. The growth potential of the target is an exceptional area where the management accountant can provide expertise in combination with the evaluation of the marketing department. Engineers provide data and assessments which allow the management accountant to investigate the technology of huge target company while taking into consideration the company’s manufacturing processes in light of latest technological developments. The task of management accountant is to quantify these assessments, compare and project the expected cost of acquisition to the cost of manufacturing the products in-house (Allison, 1984). The assessment, to be realistic and informative, must include an estimate of the cost of purchasing equipment with the latest technology as compared to the costs of acquisition. The effect of potential synergies is treated in much the same manner. Synergy is an interaction between parts that increase the effectiveness of each part to the whole. Synergy provides that the whole is greater than the sum of the parts. The acquisition of a firm that results in increasing existing product lines or geographic coverage through horizontal integration will be the most likely producer of synergy. Vertical integration involves acquisitions to get production or distribution efficiencies by acquiring firms in different, but consecutive stages of production and/or distribution. Vertical integration is less likely to produce synergies than horizontal integration (Anderson, 1987).

To quantify expected synergies and evaluate proper value requires a technical knowledge of the market in question as well as a disciplined understanding of the industry as whole, and a creative intuition to project a dynamic working relationship between the disparate parts. Another purpose of such assessment will provide a value of the potential target, which may then be compared to other available candidates.

Stage Three: Forecast Evaluation: The third stage of the process encompasses the evaluation of the target company’s financial predictions. These projections are highly significant if the acquiring firm is considering alternative acquisitions. The management accountant uses these financial forecasts to provide the basis for comparing prospective acquisitions and reaching the ultimate decision to choose or reject an individual firm. Before the forecasts can be operational, they must be carefully analysed, especially if the necessary data to articulate the forecasts has been provided by the target firm. All assumptions inferred from the data must be recognized and assessed as to their elements of risk, accuracy and reasonableness (Allison, 1984). The forecasted income statements must be analysed as to the lawfulness of projected profits and growth in sales with consideration of the economy, industry conditions and inflationary prospects. If inflation is integrated in revenue estimates, variable expenses such as labour and materials should also include appropriate increases. If absorption costing was used in the projections, preparation of estimated direct cost statements will accentuate the effect of changes in sales revenue, sales volume and manufacturing costs on profit.

After that sensitivity analysis is performed to determine the change in profit at various sales levels. An analysis of past financial statements can validate the accuracy of forecasts in relation to past results. Cash balances should be examined for peaks and valleys and a determination made as to the cause of any divergence. It is important to know if cash flow or lack were the result of the seasonal nature of the business or of unexplained origin. A close investigation of cash receipts and disbursements would also exhibit if borrowing would be necessary to provide for the normal operations of the firm. An investigation of accounts receivable can designate if customers are complying with the company’s payment terms to avoid shortcomings. The existence of old accounts may indicate uncollectibility. At the same time, accounts payable should be consistent with the payment terms of the suppliers. This appraisal may also specify the existence of excess cash, which could be used in other facets of operations. Lastly, the credit policies and collection procedures of the target company should be revised to determine the composition of their customer base. This provides the management accountant an idea of the risk involved relative to the future cash receipts of the target company (Gunther, 1979).

Examination of inventories relative to the acquisition presents an area where the management accountant may use his or her expertise to make a major contribution in the valuation process, particularly if the potential acquirer is a manufacturer or distributor and carries a large amount of inventory. The main areas of concern include a determination that the inventories are carried at the lower of cost or market and inventories do not contain out-dated things. The basis for allocating labour and overhead to work-in-process inventories must be scrutinized for reasonableness to determine that an adequate foundation exists. The management accountant should also be concerned with the amount of inventory carried in the various categories of product lines and look for any mysterious changes among raw materials, work-in-process and finished goods. The quantity of inventory in the various stages of production and product lines is also important in the valuation process (Gunther, 1979). Management accountant also perform an investigation of the components of the target firm’s asset composition. Such an analysis of property, plant and equipment may indicate that operations can be conducted at less than one hundred per cent capacity, resulting in assets which could be sold. The current market value of assets may be higher than the carrying value and these assets may be sold and leased back by the acquirer. An examination of these factors might provide cash that could be used in financing the acquisition (Gunther, 1979). As the acquisition process moves onward, an internal auditing of the accounting system is done. Accounting policies should be formalized and written and internal controls in place. The management accountant should also analyse income statements for a number of preceding years. He must know if any items that may have been omitted, such as fringe benefits for labour, sales tax, freight, sales discounts, bad debts, administrative overhead, insurance, state and local taxes, installation costs of equipment, professional fees (Allison, 1984). If a business segment of an acquired entity has been discontinued, the reasons and accounting for the transactions should be inspected. Any allocation of overhead to the discontinued segment is revised to decide whether the basis of such allocation is rational. The allocation could be a device to improve reported income from operations still in existence. Lastly, a review of significant ratios from the statement of operations should be done to determine any changes in the level of profitability (Gunther, 1979).

Stage Four: Analysis: After evaluating the financial statements and acceptance of it, the next step of the acquisition process is the analysis of the financial projections and the successive evaluation of the acquisition relative to other investment opportunities. Its internal rate of return is calculated by the management accountant and then compared to any internal financial requirements (Richards, 1986).

Stage Five: Management Review and Decision: The last step in the acquisition process is the appraisal of the reports produced by the management accountant and his team by top management. With the help of these reports and the input of the management accountant, upper level management can focus on the buying price that would be required to achieve a specified internal rate of return or a required payback period. The management accountant has numerous tools for valuing companies, including discounted cash flow analysis, the use of price/earnings multiples, and determination of the effect on the parents’ earnings per share if it acquires the targeted company. The projections and consequent conclusions drawn can be used to compare the current acquisition prospect with previous acquisitions. They can also be compared with alternative investments (Allison, 1984). There may be intrinsic rewards related with a given acquisition that may offset a comparably low internal rate of return. The target company may have a certain technology that is considered very important to long-term goals.

Stage Six: Negotiating the Acquisition: In this stage, the decision to acquire a company requires thorough analysis, expertise and intuition, each aspect of which includes a proper consideration of ethical principles. Once a decision has been made, negotiations processes are conducted that will have substantial implications upon the positive integration of the two corporations. While negotiating, it must be acknowledged that each company will have a different opinion as to the value of the firm to be acquired. Consequently, an environment must be created that allows the negotiations to proceed in a manner favourable to establish a fair value for all parties, taking into consideration the application of the ethical beliefs. The individuals who are involved in the negotiations are the same people who must accept responsibility for realising the benefits projected in the valuation procedure.

The Reasons behind Mergers and Acquisitions

There are several reasons for companies and businesses for mergers and acquisitions:

1. Mergers and acquisitions can open path for entering new markets, adding new product lines and increasing the distribution reach that is gaining a core competence to do more combinations.

2. Mergers and acquisitions are used to enhance shareholder value. This is done by Cost reductions that are achieved by combining departments, operations, and trimming the workforce. This cost reduction leads to increased productivity, increasing profits by absorbing a major competitor and thus increasing market share, cross-selling of products / services.

3. Some mergers and acquisitions occurs when management of any business identifies the need to change corporate identity. Mergers and acquisitions are also used for risk spreading.

Acquisitions are accepted to attain vertical and horizontal operational synergies where synergies indicate that the whole is greater than the parts (Sherman, 2010).

Some mergers and acquisitions take place for market ascendency and reaching economies of scale (Schuler, 2001).

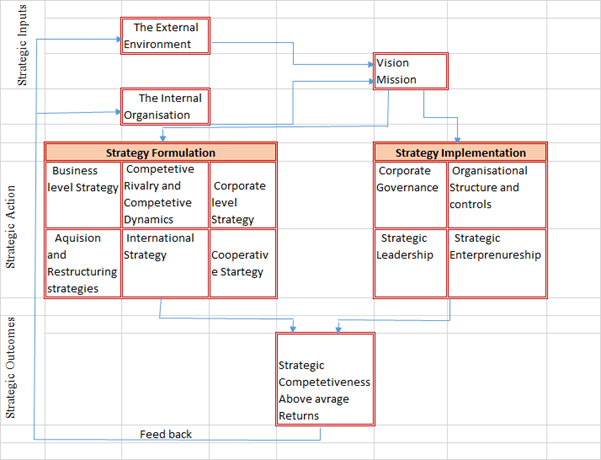

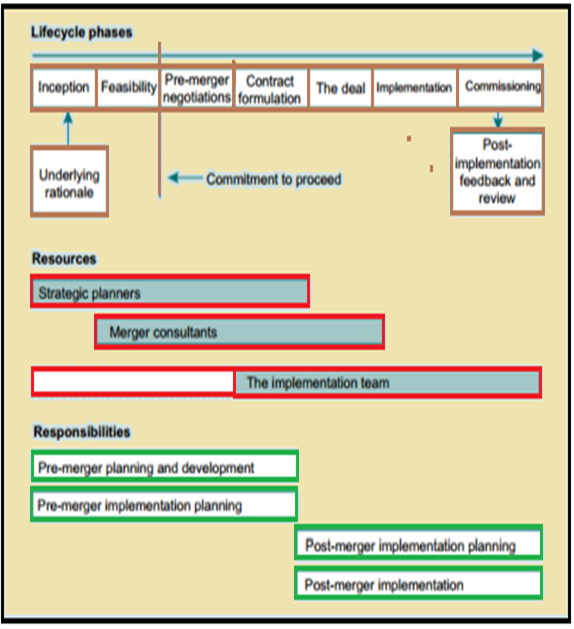

Life cycle of merger and acquisition: All mergers and acquisitions started with the inception phase. In this phase, the process is initiated by the senior managers of the organization. This step is usually followed by the feasibility stage where the financial and land logistics area is analysed. The merger or acquisition may be taking place for the upgrading the financial position and market value. The feasibility phase includes a comprehensive analysis of the financial characteristics of the proposed merger while considering timescales, synergy generation and other variables.

After the end of the feasibility phase, a proper decision is made on how to take things to the next level. In this stage, the organization commits itself to the merger or acquisition and starts allocating the funds and resources as required.

The next phase is known as the pre-merger phase and it starts instantly after the commitment to proceed. In this phase, the senior managers of both the organizations enter into negotiations to form a structure of the new combined organization. The services of external professional consultants are also needed in this phase.

After the negotiations are made, the deal takes form of a merger. The contract sets out the rights, duties and obligations of both the organizations under the terms of the deal. As soon as the contract is in place, the implementation process begins. This process includes the mechanics of actually making the merger happen. In actual scenario, merger and acquisition life cycles can be reflected in much more multifaceted terms. Practically, it is essential to divide each life cycle phase into manageable chunks to have sufficient control and response. Merger implementation managers usually establish thorough reviews and related reporting procedures and formats for each phase. The procedures is very supportive in keeping the entire merger focused and on track.

life cycle of mergers and acquisitions (Alexander, 2010)

Mergers and Acquisitions in India

In Indian scenario, the practice of mergers and acquisitions has achieved considerable significance in the existing corporate culture which is mainly used for restructuring the business entities.

History of Merger and Acquisitions in India: After India got independence, very few firms came together and had a friendly negotiated deal. The reason for slow process of mergers and acquisitions were due to the provisions of MRTP act, 1969 where the firm had to follow a strict procedure to get approval for the same which acted as a deterrent. The notion of merger and acquisition in India was not prevalent until the year 1988. After the financial transformations that occurred in the 1991, there was tough competition which pushed the Indian companies to go for Mergers and acquisitions. Afterwards it became a vital option for them to enlarge horizontally and vertically. Indian industries were exposed to numerous challenges both nationally and internationally, since the introduction of Indian economic reform in 1991. The fierce competition in global market forced the Indian firms to adopt mergers and acquisitions strategies.

The factors responsible for making the merger and acquisition deals constructive in India are:

- Dynamic government policies

- Corporate investments in industry

- Economic stability

- “Ready to experiment” attitude of Indian industrialists

Several sectors such as pharmaceuticals, IT, ITES, telecommunications, steel, construction have proved their value in the international situation and the increasing participation of Indian firms in signing Mergers and acquisitions.

Drivers of Merger and acquisitions in India:

1. Right to entry: Acquisitions that happen abroad permit Indian companies to gain access to developed markets across the globe.

2. Technology transfer: Corporations need advanced technologies to manufacture particular product or a service. By acquiring/collaborating companies abroad, they get access to the technologies.

3. Hedging Country Risks: Merger and Acquisitions are also tried to reduce the reliance on the Indian markets and escape the local business cycles.

Despite the considerable economic recession in 2009, the future of Mergers and acquisitions deals in India is bright. Indian telecom major Bharti Airtel merged with its South African counterpart MTN, with a deal worth USD 23 billion. According to the agreement Bharti Airtel would obtain 49% of stake in MTN and the South African telecom major would acquire 36% of stake in Bharti Airtel.

Major Mergers and Acquisitions deals in India:

- Tata Steel acquired 100% stake in Corus Group on January 30, 2007. It was an all-cash deal which cumulatively amounted to $12.2 billion.

- Vodafone purchased administering interest of 67% owned by Hutch-Essar for a total worth of $11.1 billion on February 11, 2007.

- India Aluminium and copper giant Hindalco Industries purchased Canada-based firm Novelis Inc in February 2007. The total worth of the deal was $6-billion.

- Indian pharma industry registered its first biggest in 2008 M&A deal through the acquisition of Japanese pharmaceutical company Daiichi Sankyo by Indian major Ranbaxy for $4.5 billion.

- The Oil and Natural Gas Corp purchased Imperial Energy Plc in January 2009. The deal amounted to $2.8 billion and was considered as one of the biggest takeovers after 96.8% of London based companies’ shareholders acknowledged the buyout proposal.

- In November 2008 NTT DoCoMo, the Japan based telecom firm acquired 26% stake in Tata Teleservices for USD 2.7 billion.

- India’s financial industry saw the merging of two prominent banks – HDFC Bank and Centurion Bank of Punjab. The deal took place in February 2008 for $2.4 billion.

- Tata Motors acquired Jaguar and Land Rover brands from Ford Motor in March 2008. The deal amounted to $2.3 billion.

- 2009 saw the acquisition Asarco LLC by Sterlite Industries Ltd for $1.8 billion making it ninth biggest-ever M&A agreement involving an Indian company.

- In May 2007, Suzlon Energy obtained the Germany-based wind turbine producer Repower. The 10th largest in India, the M&A deal amounted to $1.7 billion.

- In 2012, there was a decrement trend in mergers and acquisitions in India. This was majorly caused by the tough macro-economic climate created due to euro zone crisis and other domestic reasons such as inflation, financial deficit, and currency.

Finance express report revealed that total number of merger and acquisition deals of Indian companies in 2014 rose to 1,177 valuing at about USD 50 billion. It is the highest ever in a decade.

List of leading Indian mergers and acquisitions in 2014:

- Flipkart- Myntra: This is most important acquisition of the year. The Bangalore based domestic e-retailer acquired the online fashion portal for an undisclosed amount in May 2014. Industry analysts and insiders believe it was a $300 million or Rs 2,000 crore deal.

- Asian Paints- Ess Ess Bathroom Products: Asian paints signed a deal with Ess Ess Bathroom products Pvt Ltd to acquire its front end sales business for an undisclosed sum in May, 2014. “The company on May 14, 2014 has entered into a binding agreement with Ess Ess Bathroom Products Pvt. Ltd and its promoters to acquire its entire front-end sales business including brands, network and sales infrastructure”.

- RIL- Network 18 Media and Investments: Reliance Industries Limited took over 78% shares in Network 18 in May 2104 for Rs 4,000 crores.

- Merck- Sigma Deal: The most successful Indian manufacturers, Merck KGaA took over US based Sigma-Aldrich Company for $17 billion in cash, hoping the deal will help boost its lab supplies business. Sigma is the foremost supplier of organic chemicals and bio chemicals to research laboratories and supplies groups like Pfizer and Novartis with lab substances.

- TCS- CMC: Tata Consultancy Services the $13 billion flagship software unit of the Tata Group, has announced a merger with the listed CMC with itself as part of the group’s renewed efforts to consolidate its IT businesses under a single entity.

- Tata Power- PT Arutmin Indonesia: India’s major private power producer, Tata Power, purchased 30% stake in Indonesian coal manufacturing firm for Rs 47.4 billion. Earlier this year, they sold off 5% of its stake in PT Arutmin Indonesia (Arutmin) and PT Kaltim Prima Coal (KPC) for Rs. 250 billion due to falling coal prices globally. It plans to sell the remaining 25% stake for $ 1 billion soon too.

- Tirumala Milk – Lactalis: The main dairy actor in the world, Groupe Lactalis SA, acquired the 18 year old Hyderabad based Tirumala Milk products for a whopping Rs 1750 crore ($275 million) in January, 2014.

- Aditya Birla Minacs- CSP CX: Aditya Birla Nuvo Ltd owned ABNL IT & ITeS Ltd. was sold to a Canadian based technology outsourcing firm marking Aditya Birla’s exit for the IT industry. The deal was chalked out with a group of investors led by Capital Square Partners (CSP) and CX Partners (CXP) for $260 million (approximately Rs. 1,600 crore).

- Sterling India Resorts- Thomas Cook India: Billionaire Prem Watsa owned Thomas Cook India bought the Sterling Resorts India for Rs 870 crores, marking Thomas Cook’s entry into the hospitality sector. Thomas Cook had earlier acquired Ikya Human Solutions in 2013.

- Yahoo- Bookpad: The search engine giant, Yahoo, acquired the one year old Bangalore based startup Bookpad for a little under $15 million, though the exact amount has not been disclosed by either of the two parties concerned.

Challenges to mergers and acquisitions in India:

- Regulatory Ambiguity: Mergers and acquisitions laws and regulations are still in developing stage and trying to draw near global M&A scenario.

- Legal Developments: There have been steadily new legal developments such as the Competition Act, 2002, the restored SEBI Takeover Regulations in 2011 and also the notification of limited sections of the new Companies Act, 2013, has led to issues in India relating to their interpretations and effect on the deals valuations and process.

- Shareholder Involvement: Institutional investors in the minority position have become active in observing the investee companies.

Tactics of Merger and Acquisition

There are five primary areas that all CEO’s and strategists should address to ensure a successful Mergers and acquisitions journey:

- Internal capabilities: The process of evaluating and integrating of a target company should be done by a business development team.

- Strategic goals and alignment: It is important to appraise a company’s strategic and financial goals and determining if they can be accomplished faster or more easily through organic growth or an acquisition.

- Selection criteria: Selection should be based on post-acquisition market share, cost reduction and synergy opportunities. Flexibility should be continued as criteria in one industry may not apply to another.

- Target selection: The target selection process needs to be done quickly. It must consider that it should be explicit and transparent.

Importance of Merger and Acquisition

Mergers and acquisitions empower successful companies to expand speedily as compared to their competition through conjoining the strengths of the companies that have merged. It is established in management literature that they lead to total extinction of the feebler companies by having them acquired by other large and prosperous companies. Mergers and acquisitions are significant part of any strong economy and the primary way that companies are able to provide returns to owners and investors. Merger and acquisitions are most powerful and multipurpose growth mechanisms employed by companies of all sizes and in all industries (Sherman, 2006).

There are many benefits of merger and acquisition. Mergers and Acquisitions can make cost effectiveness through economies of scale, can boost the revenue through gain in market share and can even generate tax gains. Mergers and acquisitions often lead to an increased value generation for the company. It is anticipated that the shareholder value of a firm after mergers or acquisitions would be greater than the sum of the shareholder values of the parent companies. Mergers and acquisitions generally prosper in making cost efficiency through the execution of economies of scale.

Drawbacks of Mergers and Acquisitions

There are some drawbacks in merging of two companies. First is culture clash. When two firms have dissimilar cultures, conflicts can arise. There are some leadership issues also. Cultural clashes can be aggravated by dissatisfaction over leadership. Another drawback is Diseconomies of Scale. Consumer perception also changes when two companies merge. Merged companies need to consider how consumers view the two firms and whether or not they view them in a compatible way. To summarize, merger and acquisition is exemplified as the aspect of corporate strategy, corporate finance and management that deals with the buying, selling and combining of different companies that can help, finance, or facilitate a growing company in a given industry. The major idea behind mergers and acquisitions is that two companies together are of more value than those two companies when they are separate entities. It is basically an alliance of two companies. Companies merge with or acquire other companies to make use of one another’s strengths and these results in increased market shares and profitability that are vital for survival. Mergers and acquisitions enable companies to work as one and thus increase their total market value. Some business sectors where mergers and acquisitions take place are finance, pharmaceuticals, chemicals, oil, telecommunications, and IT.

Users Today : 320

Users Today : 320 Total views : 540963

Total views : 540963