Corporate distress, including the legal processes of corporate insolvency reorganization and liquidation, is a sobering economic reality reflects the corporate demise. Many theorists stated that each firm is unavoidably exposed to ups and downs during its development (Burbank, 2005) and corporate collapse is not an unexpected event (Agarwal and Taffler, 2008). Corporate distress is reversible process through adopting restructuring strategies. Companies undergo a distressed financial situation usually share a series of common patterns which make it problematic to estimate a possible outcome of this situation (Barniv et al., 2002). Among the distressed firms, there are little divergences in the financial weakness indicators in the different failure processes (Ooghe and Prijcker, 2008).

Historically, the business failure phenomenon was visible during the 1970s, more during the recession years of 1980 to 1982, intensified attention during the outburst of defaults and large firm bankruptcies in the 1989–1991 period, and an unparalleled interest in the 2001–2002 corporate catastrophe and troubled years.

Main persistent reason for a firm’s debacle and possible failure is managerial ineptitude. In its earlier annual publication of The Failure Record (no longer published), D&B detailed the numerous causes for failure, and those related to management invariably totalled about 90 percent. It is well established in management reports that most firms fail due to multiple reasons, but management insufficiencies are usually at the major issue. The vital cause of corporate upheaval is usually simply running out of cash, but there are a variety of means-related reasons that contribute to bankruptcies and other distressed conditions in which firms find themselves.

These causes are as under:

- Chronically sick industries (such as agriculture, textiles, department stores).

- Deregulation of major industries (i.e., airlines, financial services, health care, and energy).

- High real interest rates in certain periods.

- International competition.

- Congestion within an industry.

- Increased leveraging of corporate.

- Comparatively high new business formation rates in certain periods.

Some of these reasons are understandable for corporate distress such as high interest rates, overleveraging, and competition. Deregulation eliminates the protection of a regulated industry and promotes larger numbers of entering and exiting firms. Competition is far greater in a deregulated environment, such as the airline industry. Therefore, airline failures increased in the period of 1980s following deregulation at the end of the 1970s and have continued nearly persistent since. New business creation is usually based on optimism about the future. But new businesses do not succeed with far greater frequency than do more seasoned entities, and the failure rate can be estimated to increase in new business activity.

When any firm undergo financial distress, it cannot typically meet its debt repayment obligations using its liquid assets. Unless there is an unexpected recovery of performance, the distressed firm is likely to default on its debt. This could result in a formal bankruptcy filing, a dismissal of the management, and possibly, liquidation of the firm (Gilson, 1989). To evade this, firms typically respond to financial distress by either reorganisation assets through fire sales, mergers, acquisitions and capital expenditures reductions or liabilities (by restructuring debt-both bank loans and public debt and by injections of new capital from outside sources) or both.

Managing a catastrophe situation of companies is a fundamental issue as it is not a spontaneous process. Moulton and Thomas (1993) avowed that the restructuring during a financial distress situation are not a simple matter and the probability of a successful exit is very low. However, the percentage of firms that succeed in getting through decline cannot be disregarded.

Restructuring strategy:

In case of corporate distress, there is a need of corporate restructuring as a company needs to improve its efficiency and profitability and it requires expert corporate management. When the companies are distressed, the government may intervene and support them to recover and revive. For this, firstly the company has to declare the sick unit, in accordance with the compliances of sick industry company’s act 1985. Company is vested in the hands of board of industrial and financial reconstruction. In the best interest of company, the board may revive it, rehabilitates it or sell off the unit. Company must follow restructuring to generate funds (Rajni Sofat, 2011). In broad sense, corporate restructuring refers to the changes in ownership, business mix, assets mix and alliances with a view to enhance the shareholder value. Hence, corporate restructuring may involve ownership restructuring, business restructuring and assets restructuring.

Purpose of Corporate Restructuring:

- To enhance the shareholder value, the company should continuously evaluate its Portfolio of businesses, Capital mix, Ownership & Asset arrangements to find opportunities to increase the shareholder’s value.

- To focus on asset utilization and profitable investment opportunities.

- To reorganize or divest less profitable or loss making businesses/products.

- The company can also augment value through capital Restructuring, it can innovate securities that help to reduce cost of capital.

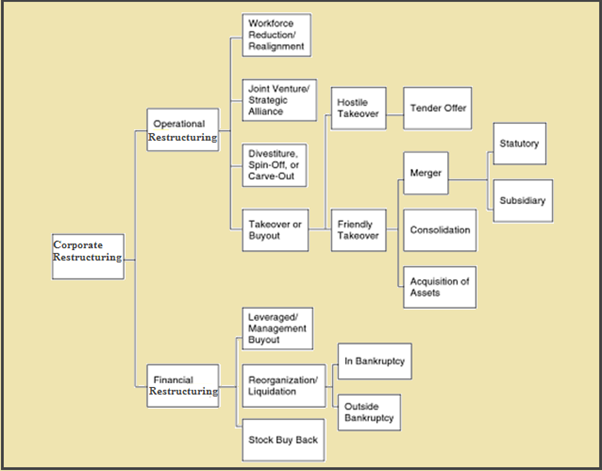

Types of Corporate Restructuring strategies:

- Mergers / Amalgamation: It is a process by which at least two companies combined to establish single firm. It is a merger with a direct competitor and hence expands as the firm’s operations in the same industry. Horizontal mergers are designed to accomplish economies of scale and result in reduce rivals in the industry. Vertical Merger is a merger which occurs upon the combination of two companies which are operating in the same industry but at different stages of production or distribution system.

- Acquisition and Takeover: Takeovers and acquisitions are common process in business area. A takeover is a distinct form of acquisition that happens when a company takes control of another company without the acquired firm’s agreement. Takeovers that occur without permission are commonly called hostile takeovers. Acquisitions happen when the acquiring company has the permission of the target company’s board of directors to purchase and take over the company.

- Divesture: Divesture is a transaction through which a firm sells a portion of its assets or a division to another company. It involves selling some of the assets or division for cash or securities to a third party which is an outsider. Divestiture is a form of contraction for the selling company. It is a means of expansion for the purchasing company. It represents the sale of a segment of a company (assets, a product line, a subsidiary) to a third party for cash and or securities.

- Demerger (spin off / split up / split off): It is a type of corporate restructuring policy in which the entity’s business operations are segregated into one or more components. A demerger is often done to help each of the segments operate more smoothly, as they can focus on a more specific task after demerger. Spinoffs are a way to offload underperforming or non-core business divisions that can drag down profits. Split-off is a transaction in which some, but not all, parent company shareholders receive shares in a subsidiary, in return for relinquishing their parent company’s share. Split-up is a transaction in which a company spins off all of its subsidiaries to its shareholders and ceases to exist.

- Joint Ventures: Joint ventures are new enterprises owned by two or more contributors. They are typically formed for special purposes for a certain period. It is a combination of subsets of assets contributed by two (or more) business entities for a specific business purpose and a limited duration. Each of the venture partners continues to exist as a separate firm, and the joint venture represents a new business enterprise. It is a contract to work jointly for a period of time. Each member expects to gain from the activity but also must make a contribution.

- Buy back of Securities: Buy Back of Securities is significant process for Companies who wants to decrease their Share Capital.

- Franchising: Franchising is also effective restricting strategy. It is an arrangement where one party (franchiser) grants another party (franchisee) the right to use trade name as well as certain business systems and process, to produce and market goods or services according to certain specifications.

- A leverage buyout (LBO) is any acquisition of a company which leaves the acquired operating entity with a greater than traditional debt-to-worth ratio.

A corporate restructuring strategy involves the dismantling and renewal of areas within an organization that needs special attention from the management. The procedure of corporate reformation often ensues after buy-outs, corporate attainments, takeovers or bankruptcy. It can involve an important movement of an organization’s accountabilities or properties.

Basically, organizational reorganisation involves making numerous transformation to the organizational setup. These changes have great impact on the flow of authority, responsibility and information across the organization. The causes for restructuring differ from diversification and growth to lessening losses and cutting down costs. Organizational restructuring may be done because of external factors such as amalgamation with some other company, or because of internal factors such as high employee costs. Restructuring strategy is about decreasing the manpower to retain employee costs under control.

When management formulate restructuring strategies for a business and implement, it can result in several changes to a company’s organizational structure, product mix, financing strategies and overall operations. The modifications that occur during a corporate reorganization depend on the problem or opportunity that the business hopes to address with the change. Understanding the effects of reformation business will help management to make more informed decisions and lessen their need to take on more debt or sell part of company.

The unrelated business of highly diversified firm may be divested and all the resources focused on core products and services. This helps the company gain a competitive edge. This reduces cost and generate cash inflow which can be redirected to invest in core products production and marketing (Rajni Sofat, 2011).

Corporate restructuring process (Donald M. DePamphilis, 2007)

Restructuring is done through product differentiation. Company can opt for making significant changes in the existing products according to the recent market requirement (Rajni Sofat, 2011).

Company can also focus on quality enhancement of its product at each step in production process to add a new dimension and enhancement to existing product or services (Rajni Sofat, 2011).

Some restructuring strategies need an organizational change. This might result after a business go into a new market, requiring separate business units to share administrative functions or a corporate headquarters to supervise independent divisions. A reorganization may need to develop a new management team or a small business owner to sell part of the business and bring on a new partner or associates. A company that formerly subcontracted most of its administrative functions might bring them in-house. In other cases, a dealer of products who buys those products from sub-contractors might begin manufacturing the products instead of buying them. When two companies amalgamate, one layer of management and other redundant employees must be terminated, resulting in mass dismissals.

If a company cannot fulfil its capital requirements, it might sell stock or take on investors. This would permit the business to buy another company, open new places or add new products to its business. These changes requires the company to modify its financing strategies based on its new debt load and long-term financing needs. If a company has too much debt to operate lucratively, it might reorganize by taking out new loans at higher interest rates but lower monthly payments. Selling stock or part of the business are two possibilities to help reduce debt. Some restructurings focus on cost-containment, which can result in changing the mix of in-house and outsourced functions the company uses, as well as modifications to its product line, labour use and operations. In this situation, the company might renegotiate its contracts with vendors, suppliers, contractors, leasing companies, creditors and personnel.

In the process of restructuring, corporation enters into a new marketplace. It might need to restructure the business if the new products or services require a different skill set. This might mean adding a division to the company or opening a new production facility.

Another restructuring process is to devise different Distribution Strategy. To restructure a business, company sell using different distribution channels. If a company has sold only through intermediaries and decides to add direct sales, the company will need to address the operational changes that come with direct sales. This might include changes to its sales force, order-taking processes, product fulfilment, accounting services, and customer service and information technology. An effective restructuring strategy that companies in distress adopt is Re-branding. When a business goes through a restructuring due to a change in its product mix or distribution strategy, it might need to change its marketing message. Depending on whether the company’s exclusive selling differential and key benefit change, the business might need to build a new brand message and brand-management policy.

To summarize, corporate distress may be due to intense competition, high interest rates and drastic changes in the marketplace which put the company to bankruptcy. Financial distress has significant impact on domestic economic activities (Papa M’B. P. N’Diaye, 2010). In this situation of corporate failure, there is requirement to devise restructuring strategies. Restructuring a business can assist a struggling company improve its position or help a successful business to expand more. A restructuring might involve altering significant processes in administration, marketing and adopting distribution strategies, addressing debt-service and financing strategies, entering into a new market or modifying the company’s product or service.

Users Today : 533

Users Today : 533 Total views : 469015

Total views : 469015