International production deals with production of goods and services in international locations and markets. It involves management process which has to take into consideration local production market (labour and capital) and international customer necessities. The international production encompass vertical production chains extended across the countries in the region as well as distribution networks throughout the world. The major actors are corporate firms belonging to the machinery industries, including general machinery, electrical machinery, transport equipment, and precision machinery though some firms in other industries, such as textiles and garment, also develop the network.

The development of international production and distribution networks in East Asia was originated by radical changes in development strategies of each country. In the mid-1980s and the early 1990s, the East Asian developing economies started applying new development strategies in which the benefit from hosting foreign direct investment (FDI) was aggressively discovered. The new development policies also highlight the utilization of market forces, but they are not simple laissez-faire policies; rather, they pursue new roles of government involvement in the process of development. East Asia presented a model of new development strategies in the age of globalization. The development of international production and distribution networks in East Asia has also provided substantial impact on our academic thought on trade and FDI patterns. The traditional comparative advantage theory still has a certain explanatory power in the interpretation of across industry location choices, based on international differences in technological level and factor prices. The importance of the trade in intermediate goods as well as the industrial clustering has stimulated the development of new theoretical thoughts in international trade theory, particularly in the literature of fragmentation theory and agglomeration theory. In addition, the sophisticated pattern of intra-firm corporate structure and inter-firm relationship developed in East Asia has inspired research to incorporate the analysis of corporate behaviour into international trade theory beyond the traditional approach of trade and FDI.

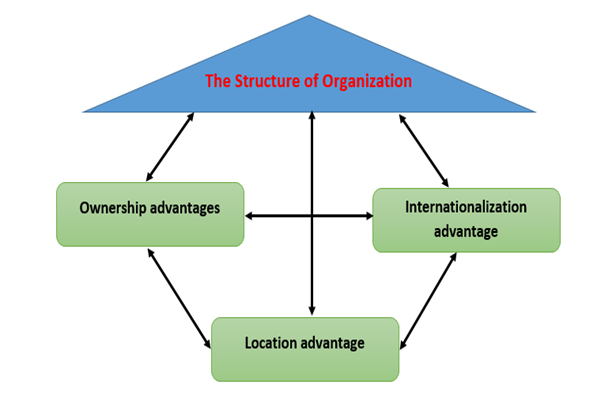

Theorists stated that International production is value adding activity owned or controlled, and organized by a firm outside its national boundaries (Dunning, 1988, p.1). General theory of international production proposed by John Dunning first advocated in the late 1970 s, has generated considerable discussion. This work thoughtfully reassesses the paradigm, and extends the analysis to Policy autonomy, their own official history of capital. Dunning’s eclectic paradigm (OLI) has been the most influential framework for empirical investigation of determinants of foreign direct investment (Dunning, 2001).

The eclectic paradigm provides holistic background to scrutinise the significance of factors influencing both the initial development of multinational enterprises by foreign production and the consequent growth of their activities (Dunning & Robson, 1987). The general and operationally testable paradigm of international production rests on a combination of the three doctrines of the eclectic paradigm and behavioural and financing considerations. The framework facilitates comparison between different theories by establishing the common ground between various approaches and by clarifying the specific questions theorists have posed, as well as the different levels of analysis (Cantwell and Narula, 2001).

The basic postulation of the eclectic paradigm is that the returns to FDI, and hence FDI itself, can be explicated by a set of three factors: the ownership advantages of firms ‘O’, indicating who is going to produce abroad ‘and for that matter, other forms of international activity’ (Dunning, 1993) ; by locational factors ‘L’ ‘influencing the where to produce’ (Dunning, 1993) and by the internalisation factor ‘I’ that ‘addresses the question of why firms engage in FDI rather than license foreign firms to use their proprietary assets’ (Dunning, 1993).

To compete in a foreign location, company must possess certain ownership advantages that can compensate for the additional costs related with setting up and operating abroad. These are costs which are not faced by domestic producers (Dunning, 1988). Essentially, the firm has unique ownership advantages which its competitors do not have. These unique ownership advantages are the future investment options of the firm. The firm may be observed as a combination of assets-in-place and future investment options. The lower the proportion of firm value represented by assets-in-place, the higher the growth opportunities. Myers (1977) designates these potential investment opportunities as call options whose values depend on the likelihood that management will exercise them. Like call options, the growth options represent real value to the firm (Kester, 1984). These growth options are intangible assets or ownership advantages that represent the investment opportunity set.

The second situation of international production is that the company must be better off transferring its ownership advantage within the firm across national boundaries instead of selling it to a third party via licensing or franchising. This second factor is the internalisation and has been demarcated by Dunning (1993) as a choice between investing abroad and licensing a firm to exploit ‘O’ advantages possessed by the licensor. The internalisation of ownership advantages occurs when the international market is not the best modality for transacting intermediate goods or services. This can reveal a possible market failure (Dunning, 1988). The greater the perceived costs of market failure, the more attractive it is for multinational enterprises to internalise their ownership advantages. When there is no external market for the firm’s ownership advantages the distinction between ‘I’ and ‘O’ may be inappropriate (Dunning, 1988). The eclectic paradigm of international production stipulates locational advantages as the second determinant of the extent, form, and pattern of international production. Basically, the benefits of multinational enterprises are associated with locating certain activities in particular countries. When it is in the best interest of the MNEs to locate their activities in other than the home country, the MNEs use their locational advantages to respond to a kind of spatial market failure, basically “internalizing exogenous spatial imperfections (Rugman 1981).

The third level of the eclectic paradigm of international production is the internationalization advantages. They refer to the relative benefits related with serving foreign markets. With internalization advantages present, it is to the benefit of the multinational enterprises to transfer its ownership advantages abroad rather than sell them. The perceived great costs of transactional failure lead the multinational enterprises to transfer its advantages across national borders rather than by contractual agreements with foreign firms. Rugman (1981) debated that the multinational enterprises have a sense to “internalized” the market for its use. The multinational enterprises will proceed with the internalization if the rate of return on foreign assets is superior or equal to the rate of return on total assets. It can be said that the third condition of the eclectic paradigm is related with the ‘where’ of production. Multinational enterprises will chose to produce abroad whenever it is in their best interests to combine intermediate products produced in their home country which are spatially transferable with at least some immobile factors or intermediate products specific to the foreign country (Dunning, 1988).

OLI Model of Dunning (2001)

Extension of the eclectic paradigm of international production is the contemplation of firm-specific behavioural differences (Dunning, 1988b). Principally, multinational enterprises espouse specific strategies to describe their international posture. While these strategies may not be recognized to the general public, they are revealed in the reputation of the firm. The reputation of a firm is significant for various decisions ranging from resource allocation and career decisions to product choices, to name only a few (Dowling, 1986).

It is an important sign of the firms’ organizational effectiveness. Favourable reputations can create favourable situations for firms that include the generation of excess returns by inhibiting the mobility of rivals in an industry (Caves and Porter, 1977), the capability of charging premium prices to consumers (Klein and Leffler, 1981) and the creation of a better image in the capital markets and to investors (Beatty and Ritter, 1986). To enhance reputation, firms signal their key characteristics to constituents to maximize their social position (Spence, 1974).

Another extension of the eclectic paradigm of international production is the consideration of firm-financing differences (Dunning, 1988). It ascends from Aliber’s (1983) dissatisfaction with the eclectic paradigm, and his focus on financing as a determinant of multi-nationality. The multinational enterprises uses different currencies to acquire foreign assets, taking advantages of structural or transactional imperfections in international capital and foreign exchange markets. It is the skill to finance investments in different currencies that characterizes the uniqueness of the multinational enterprises. This ability to finance part of its production in its home currency and other parts in other currencies depends on the ability of the firm to raise capital, i.e. on its leverage. Therefore, the level of multi-nationality will depend on the financial leverage of the multinational enterprises.

To summarize, The eclectic paradigm of international production by multinational enterprises debated that the primary act of foreign production by enterprises and the progress of such production depend crucially upon the formation of three elements that include firm-specific (or ownership-specific) advantages, country-specific (or locational) advantages, and internalization advantages (Dunning, 1988).

Users Today : 73

Users Today : 73 Total views : 463744

Total views : 463744