Financial statements are the summaries of the operating, financing and investment activities of business. It must give useful information for investors and creditors in making investment, credit and other business decisions (Pamela, 1999). Financial statement analysis in accounting arena is effectual device for different users of financial statements, each having dissimilar objectives to learn about the financial circumstances of the unit. Financial statements are developed to take wise decisions for company. Financial statement analysis compares ratios and trends calculated from data found on financial statements. Financial ratios permit experts to compare output of business to industry averages or to specific competitors. These comparisons assist recognize financial vigour and flaws. The term ‘financial analysis’ also termed as ‘analysis and interpretation of financial statements’, denotes to the process of determining financial strengths and limitations of the company by establishing strategic affiliation between the items of the balance sheet, P&L A/c and other operative data. It is the combined name for the tools and techniques that gives significant information to decision makers.

The main intent of financial analysis is to analyse the information contained in financial statements in order to review the prosperity and financial reliability of the firm. A financial analyst appraises the financial statements with various tools of analysis before reporting on the financial strength or weakness of an enterprise. Basically, it is done to assess the financial status and performance of entity from the information contained in financial statement.

Financial statement analysis is a noteworthy business movement because financial statements of firms present helpful information on its financial rank and profit levels. These statements also assist a shareholder, a regulator or a company’s top management executive to recognize operating data, assess cash receipts and payments during a period and evaluate owners’ investments in the company. A good analysis and explanation of financial statement can offer valuable insights into a firm’s performance.

It facilitates investors and creditors to evaluate past performance and financial status and predict future performance. The principal objective of financial reporting is to give information to present and potential investors and creditors and others to make rational investment, credit and other decisions. Successful decision making requires assessment of the past performance of companies and assessment of their future prospects. Major aim of a company’s financial analysis for a specific period is to consider the financial position of the company, where it views the company’s financial balance and debt performance. The obtained parameters are of great importance, since it is the vital for growth, development and continued existence of companies, mainly because they determine the ability of its financing. Financial analysis is also helpful to determinate the proprietary position of the company, which aims to thoroughly analyse company’s assets in terms of manifestations, to analyse the structure of assets, the satisfactoriness of their goals and objectives, and to find out the degree of capacity utilization, efficiency of use and speed of their skill. Financial analysis is valuable for firms to determinate the position of the company yield, based on the determination of earnings power, and to analyse income statement or to analyse the structure of incomes and expenditures, including analysis of the lower point of return and quantification of the business, financial and overall business risks.

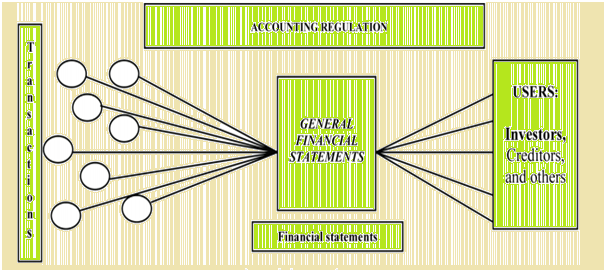

Financial statements must be realistically presented for quality business and investment decisions, which indicates that their reliability has to be confirmed through the system of external control by independent third parties such as auditors. The analysis of financial statements by their users aims to change the information presented in succinct and accessible forms for certain decisions.

Financial reporting process (Source: Demirovic, 2015)

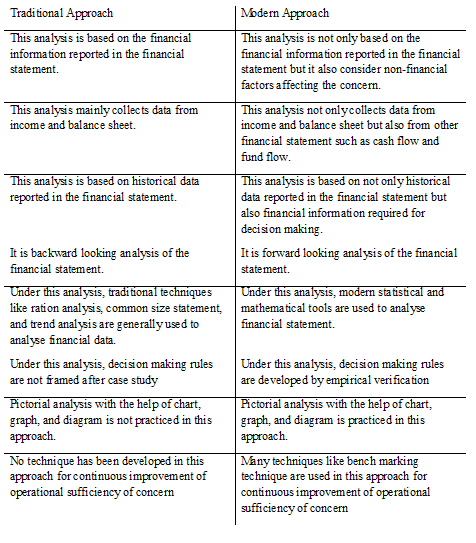

Approaches: There are two major approaches for financial statement analysis that include traditional and modern approach. Traditional approach is based on the financial data contained in financial statement and considers the statement composed of income statement and balance sheet. Financial ratios are used to assess the monetary position of firm. Modern approach to financial statement analysis emphasizes financial and non-financial factors of financial statements.

Table: Differences between traditional and modern approaches of financial statement analysis: (Source: Bhattacharyya, 2011 )

Function

Key function of financial statement analysis is that it enables firms to review operating data and appraise intermittent business performance. A corporation also may evaluate financial statements to estimate levels of cash flows and owner investments. On the other hand, a regulator may review a company’s retained earnings statement to evaluate corporate shareholders’ accounts.

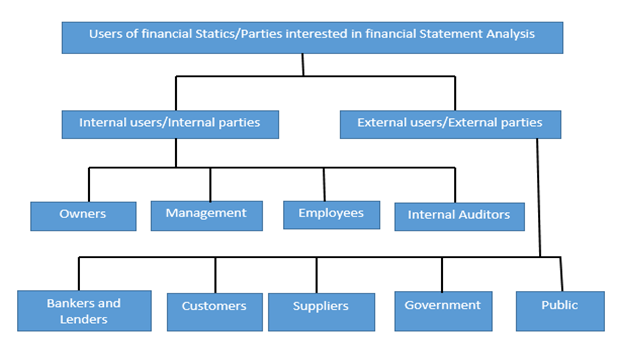

Different parties involved in financial statement analysis: In this analysis, different users are interested which are categorized into two parts:

Different users of financial statement (Source: Bhattacharyya, 2011)

Techniques and tools of financial statement Analysis

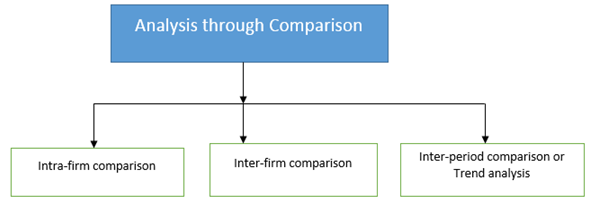

Financial statements provide thorough information about assets, liabilities, equity, reserves, expenses and profit and loss of an enterprise. They are not readily understandable to concerned parties such as creditors, shareholders, and investors. Therefore numerous techniques are used to analyse and interpret the financial statements. Techniques of analysis of financial statements are mainly categorized into three types:

- Cross-sectional analysis: It is also termed as inter firm comparison. This analysis assists in analysing financial attributes of an enterprise with financial characteristics of another parallel enterprise in that accounting period.

- Time series analysis: It is also known as intra-firm comparison. This procedure indicates the relationship between different items of financial statement is established, comparisons are made and results obtained. The basis of comparison may be comparison of the financial statements of different years of the same business unit, comparison of financial statement of a particular year of different business units.

- Cross-sectional cum time series analysis: This analysis is aimed to compare the financial characteristics of two or more enterprises for a definite accounting period. It is possible to extend such a comparison over the year. This approach is most successful to appraise financial statements.

The scrutiny and explanation of financial statements is used to verify the financial status of the firm. Various tools or methods are used to study the relationship between financial statements.

- Comparative financial statements

- Common size statements

- Trend analysis

- Ratio analysis

- Funds flow analysis

- Cash flow analysis

- Comparative financial statements: comparative study of financial statements is the comparison of the financial statements of the business with the preceding year’s financial statements. It facilitates detection of weak points and applying remedial measures. Practically, two financial statements (balance sheet and income statement) are prepared in comparative form for analysis purposes.

- Comparative Balance Sheet: The comparative balance sheet demonstrates the different assets and liabilities of the firm on different dates to make comparison of balances from one date to another. The comparative balance sheet has two columns for the data of original balance sheets. A third column is used to show change (increase/decrease) in figures. The fourth column may be added for giving percentages of increase or decrease. While interpreting comparative Balance sheet the interpreter is accepted to study the following aspects:

- Current financial position and Liquidity position

- Long-term financial position

- Profitability of the concern

- For studying current financial position or liquidity position of a concern, interpreter must investigate the working capital in both the years. Working capital is the excess of current assets over current liabilities.

- For studying the long-term financial position of the concern, one should examine the changes in fixed assets, long-term liabilities and capital.

- Another aspect to be understood in a comparative balance sheet is the profitability of the concern. The study of increase or decrease in profit will help the interpreter to observe whether the profitability has improved or not.

After studying various assets and liabilities, a judgment should be formed about the financial position of the concern.

- Comparative Balance Sheet: The comparative balance sheet demonstrates the different assets and liabilities of the firm on different dates to make comparison of balances from one date to another. The comparative balance sheet has two columns for the data of original balance sheets. A third column is used to show change (increase/decrease) in figures. The fourth column may be added for giving percentages of increase or decrease. While interpreting comparative Balance sheet the interpreter is accepted to study the following aspects:

- Common size statements and trend analysis: The common size statements (Balance Sheet and Income Statement) are revealed in analytical percentages. The figures of these statements are shown as percentages of total assets, total liabilities and total sales correspondingly.

Common size balance sheet: A statement where balance sheet items are expressed in the ratio of each asset to total assets and the ratio of each liability is expressed in the ratio of total liabilities is called common size balance sheet. Thus the common size statement may be prepared in the following way.

- The total assets or liabilities are taken as 100.

- The individual assets are expressed as a percentage of total assets i.e. 100 and different liabilities are calculated in relation to total liabilities.

Trend analysis: Trend analysis appraises an organization’s financial information over a period of time. Periods may be measured in months, quarters, or years, depending on the circumstances. The objective is to compute and analyse the amount change and percent change from one period to the next. For calculating the percentage change between two periods, calculate the amount of the increase (or decrease) for the period by subtracting the earlier year from the later year. If the difference is negative, the change is a decrease and if the difference is positive, it is an increase. Divide the change by the earlier year’s balance. The result is the percentage change. To calculate the change over a longer period of time, select the base year. For each line item, divide the amount in each non base year by the amount in the base year and multiply by 100.

Figure: Analysis through comparison (Source: Sinha, 2009).

- Ratio analysis: Ratio Analysis is used to get a fast indication of a firm’s financial performance in major areas. It is a process of determining and interpreting numerical relationship based on financial statement. It is a technique of interpretation of financial statement with the help of accounting ratios derived from the balance sheet and profit and loss account. The ratios are categorized as Short-term Solvency Ratios, Debt Management Ratios, Asset Management Ratios, Profitability Ratios, and Market Value Ratios.

- Funds flow analysis: Fund flow analysis is associated with more specific information as compared to the wide range of ratio metrics. Fund flow analysis reveals information about the inflows and outflows of capital for a specific period of time. Fund flow analysis may disclose why certain ratio valuations are relatively high or low in a company by digging down into the actual movement of cash and assets into and out of a company. Fund flow analysis involves creating fund flow statements that match capital inflows with outflows.

- Cash flow analysis: Cash flow statement represents inflow and outflow of funds. It is important tool for short term analysis.

Advantages

Financial statement analysis is an important business practice because it facilitates senior management to reassess a corporation’s balance sheet and income statement to estimate levels of monetary position and success. Financial statement analysis may be essential for management to recognize levels of cash receipts and disbursements in business operations. A statement of cash flows lists cash flows related to operating activities, investments and financing transactions. A statement of owners’ equity may facilitate an investor to recognize a company’s shareholders.

Major characteristics to improve the financial statements:

- Intelligibility which indicates that the information contained in financial statements should be accessible in such a way that users can comprehend it, so they could communicate the intended meaning. Will statements be understandable or not depends on how they are compiled by accountants, and how they are used by the users (decision makers), who should have the basic knowledge to interpret information and to use them for adoption and implementation of certain business activities.

- Comparability: To decide the trend of changes in financial situation and to determine productivity of business enterprises, it is imperative through consistent adherence to evaluation and measurement of the effects of business events from period to period. This characteristic should allow investors, creditors and others to identify and appreciate financial statements of entities in the flow of time, and to compare the financial statements of different entities (Stanovcic,. 298). At last, comparability of financial statements is provided if the users are timely informed about the changes in accounting policy in the same or in different companies.

- Timeliness: It entails that if company want that instruments of financial reporting had a great use value, especially for decision-makers they must be submitted to a reasonable time.

- Verifiability: This characteristic is a new attribute from 2010 Framework. The information is confirmable in the sense that it should ensure credibility and objectivity. It necessitates that independent observers reach the same or similar conclusions that is not biased or contains material errors and recognition of the chosen method of assessment is applied free from material error and subjectivity (Škarić, Jovanović, K., 6).

Limitations Of Financial Statement Analysis

- It is just study of temporary reports.

- It checks just financial aspect of company’s performance and position but it ignores non-monetary characteristic of company.

- It does not investigate the changes in price level of different items of financial statements.

- Many accounting theories and conventions are used to prepare financial statement and these concepts and conventions are established for analysis. So, analysis is totally affected with these accounting concepts.

- Analysis of financial statements is just source but not conclusion or result because reviewer or evaluator, who writes its analysis, may also affect the analysis. So, different interpretation by different person may become its restraint.

It can be said that in financial statements, there is lack of Precision, lack of Exactness, Incomplete Information, hiding of Real Position or Window Dressing, lack of Comparability, and there is historical cost.

To summarize, financial statement analysis is helpful in appraising the operational competence of the management of a company. The actual performance of the company which are divulged in the financial statements can be compared with some standards set earlier and the any difference between standards and actual performance can be used as the marker of effectiveness of the management. Briefly, financial statement analysis is the analysis, interpretation and comparison of monetary data in order to accomplish desired results.

Users Today : 360

Users Today : 360 Total views : 463612

Total views : 463612